Project Overview

At Ally Financial, I led the UX strategy and design for a redesigned Agent-Assisted Application (3A) experience that addressed a critical accessibility gap. Many borrowers lacked email access or chose not to engage digitally, which prevented them from completing their applications. I was responsible for uncovering the root causes, aligning with legal and operational constraints, and designing an inclusive solution that expanded access without compromising compliance or efficiency.

Solution

I designed a hybrid workflow that allowed providers to print, wet sign, and upload documents on behalf of borrowers, eliminating the need for email authentication. This solution offered a seamless alternative for users impacted by the digital divide, while maintaining regulatory compliance and ensuring a smooth experience for providers.

Impact

By simplifying the process for borrowers without digital access, this solution captured a previously excluded user segment. Within months of launch, the hybrid experience contributed to a 10% lift in loan volume. The redesigned flow also improved internal operations by reducing reliance on workaround emails and lowering the burden on Customer Care teams.

My Role

Owned UX strategy and design execution across Legal, Risk, Compliance, Marketing, Engineering, and Product

Led stakeholder and provider interviews to identify usability gaps and compliance blockers

Created and iterated on mockups, validating solutions through usability testing

Simplified document handling and introduced clear CTAs to reduce friction and error across the journey

Redefining Accessibility in Lending: Designing a Seamless Agent-Assisted Application Experience

When I joined Ally Financial in February 2022 as a Senior UX Designer, I stepped into the challenge of designing within a highly regulated financial environment, an area I had not previously worked in. I supported the Lending division, which provided B2B2C financing solutions across verticals like Home Improvement, Healthcare, and Retail. My role involved leading UX for initiatives that aimed to streamline operations and improve borrower experience across Ally’s internal systems and customer-facing platforms.

One of my first and most complex challenges centered on the Agent-Assisted Application (3A) experience. In this workflow, borrowers were expected to complete key steps such as accepting disclosures and signing agreements digitally via email. However, I quickly identified a major blocker: a significant portion of borrowers either did not have an email address or chose not to provide one, which excluded them from the process entirely.

This created two critical issues:

Compliance Risk – Email was used for authentication, disclosure delivery, and digital signing. Without it, borrowers could not progress.

Operational Breakdown – Customer Care agents had no tools or workflows to support these applicants, which led to delays and inconsistencies.

As the lead designer, I was responsible for redefining this experience. My objective was to make it functional, inclusive, compliant, and efficient. The goal was to design a new workflow that allowed non-digital borrowers to complete their applications without email while also equipping Customer Care with the tools they needed to review and process documents accurately and on time.

Bridging the Digital Divide: Research & Competitive Insights in Lending

Before I joined the project, the team had conducted early business research to explore challenges and opportunities in the lending space, particularly around the impact of the Digital Divide. This term refers to the gap between individuals who have reliable access to digital technology and those who do not. When I came on board, I reviewed this research and used it as a foundation to guide my next steps.

The initial research focused on three core areas:

Identifying major trends in how the Digital Divide affects potential borrowers

Understanding the systemic and social barriers that prevent users from completing digital loan applications

Evaluating how redesigning the non-digital loan experience could improve Ally Lending’s operational performance and competitive positioning

This background helped frame the opportunity. I saw a clear path to drive both business and social impact by improving accessibility for borrowers who had previously been overlooked by digital-first processes.

Key Digital Divide Trends

Demographics: The Digital Divide predominantly affects older adults, rural populations, and low-income individuals, limiting their ability to complete digital financial transactions.

Market scan & competitive opportunity

Systemic Barriers: The primary drivers of the Digital Divide stem from broader systemic issues, including digital literacy gaps and the availability of necessary technological infrastructure.

To complement the internal research, I led a competitive scan to assess how other lending institutions were addressing the needs of non-digital borrowers. I wanted to understand whether this was a widespread industry challenge or a unique gap Ally had the opportunity to own.

Through this external research, I found that most competitors still relied heavily on digital-first flows, with few offering a clear alternative for applicants without email or device access. This confirmed that there was a significant opportunity for Ally to differentiate itself in the market.

These insights also helped build a stronger business case internally. By evaluating how a paper-based loan application flow could increase application completion rates and reduce customer support burden, I was able to position the redesign as not only a user-centered solution but also a strategic advantage for the business.

To better understand how Ally could lead in inclusive lending, I conducted a competitive analysis focused on how others were addressing the Digital Divide. My goal was to assess how reimagining the non-digital loan application process might impact Ally Lending’s position in the market.

I began with an external scan of companies streamlining the loan initiation and administration experience. I looked at both fintech disruptors and traditional lenders, paying close attention to how they accommodated borrowers without consistent access to email, smartphones, or broadband.

Key Competitors in Loan Administration

Greensky: Offers merchant solutions and paper-based workarounds

LendKey: Connects borrowers to credit unions through white-label loan platforms

FinMKT: Powers point-of-sale financing with flexible loan infrastructure

Upstart: Uses AI to match borrowers with bank partners

Experian: Provides verification and loan processing tools

Digital Divide Adaptations Across the Industry

Freddie Mac: Uses Remote Ink Notarization for offline document execution

Lending Club: Supports in-person loan processing at healthcare facilities

CareCredit: Allows phone-based approvals

Greensky: Leverages audio and video recording for document authentication

Most solutions were piecemeal or operationally complex. Few offered a scalable and compliant hybrid experience that could be embedded seamlessly into existing workflows. Greensky’s approach showed promise but required significant operational overhead, making it difficult to scale.

Emerging Digital-First Disruptors

SoFi: Continues to set user experience benchmarks through sleek, digital-only workflows

WellPay (Affirm): Provides fast, flexible financing with simplified digital onboarding

Lightstream: Offers unsecured personal loans through frictionless, user-centered flows

While many competitors focused on digital-first innovation, I saw an opportunity for Ally to differentiate through compliance, accessibility, and scale. Instead of chasing sleek UX for the already-connected, Ally could lead by designing for borrowers often left out of the conversation.

This insight helped shape my design strategy—not to match industry trends, but to fill a meaningful gap that others were ignoring.

PERSONA DEVELOPMENT

To better empathize with borrowers affected by the Digital Divide, I created lightweight personas grounded in qualitative research. These personas were not built in isolation. I developed them based on patterns I uncovered through stakeholder interviews, direct conversations with providers across the healthcare and home improvement sectors, and internal insights from Ally’s Customer Care and Compliance teams.

I focused on identifying recurring variables such as age, income level, geographic location, and comfort with technology. These traits helped surface common barriers and behaviors—like limited access to email, a preference for in-person interactions, or reliance on caregivers to navigate financial processes.

Rather than building fully detailed personas, I kept them intentionally simple and focused. Each one was designed to be immediately actionable for design and product discussions. They served as a constant reference point to ensure our solutions stayed grounded in real user needs, not assumptions.

This approach helped push the team toward more inclusive decisions early in the process, from interface language to verification workflows. It also helped bridge communication across teams by making the user story concrete, visible, and relatable.

With research synthesized and personas defined, I moved into the design phase with a clear strategic foundation. The insights I gathered shaped the design direction and helped me pinpoint the key moments in the journey where friction was highest—both for borrowers navigating the application and for providers trying to support them.

I used this input to identify where compliance risk, user confusion, and operational inefficiencies intersected. These were the areas where thoughtful design could have the greatest impact.

It was time to translate findings into a tangible, inclusive solution. My goal was not just to fix what was broken, but to build a workflow that removed barriers, simplified handoffs, and made the process more accessible for everyone involved.

Current State Gaps: Mapping the Road to Inclusive Design

My UX strategy was shaped directly by the findings from my current state analysis of the Agent-Assisted Application (3A) flow. As I mapped the borrower and provider journey, the friction points were undeniable.

First, there was no compliant alternative to signing disclosures and loan agreements with pen and paper. Second, the prequalification step required an email address, which excluded many borrowers from moving forward. Third, the system lacked a verifiable method for proving that providers had reviewed loan offers alongside the borrower, something required for compliance.

On top of that, the entire process assumed that every borrower had access to a personal device, which was not the case for many of the users we were trying to serve. This over-reliance on technology created avoidable barriers for people already on the margins.

These gaps became the foundation for my design priorities. They informed every decision I made about workflows, interface behaviors, and documentation methods. My goal was to eliminate these roadblocks without introducing additional complexity or compliance risk.

After evaluating multiple paths forward, I made the strategic decision to build on the existing 3A workflow rather than design an entirely new flow from scratch. This allowed me to preserve alignment with Ally’s compliance-approved infrastructure while also accelerating implementation and minimizing development lift.

My goal was to reduce friction for non-digital borrowers while staying within the boundaries of what could be safely executed in a highly regulated environment. I focused on designing key enhancements that would solve the core issues without adding operational complexity.

Key Features Introduced

Print and Wet Sign Workflow: I enabled providers to print disclosures, terms and conditions, and loan agreements for physical signatures. This gave borrowers an alternative to digital signing while still preserving compliance.

Upload Capability: I introduced a new flow that allowed providers to upload signed documents directly into the system. This eliminated the need for borrower email authentication and helped streamline approvals.

Improved Verification and Compliance Protocols: I collaborated with Legal and Risk teams to ensure that the updated process included clear guardrails to prevent fraud and invalid submissions. Every step was designed with auditability and legal defensibility in mind.

These enhancements kept the experience lightweight, intuitive, and compliant while making the application process more accessible to a segment of users who had previously been excluded.

Happy path

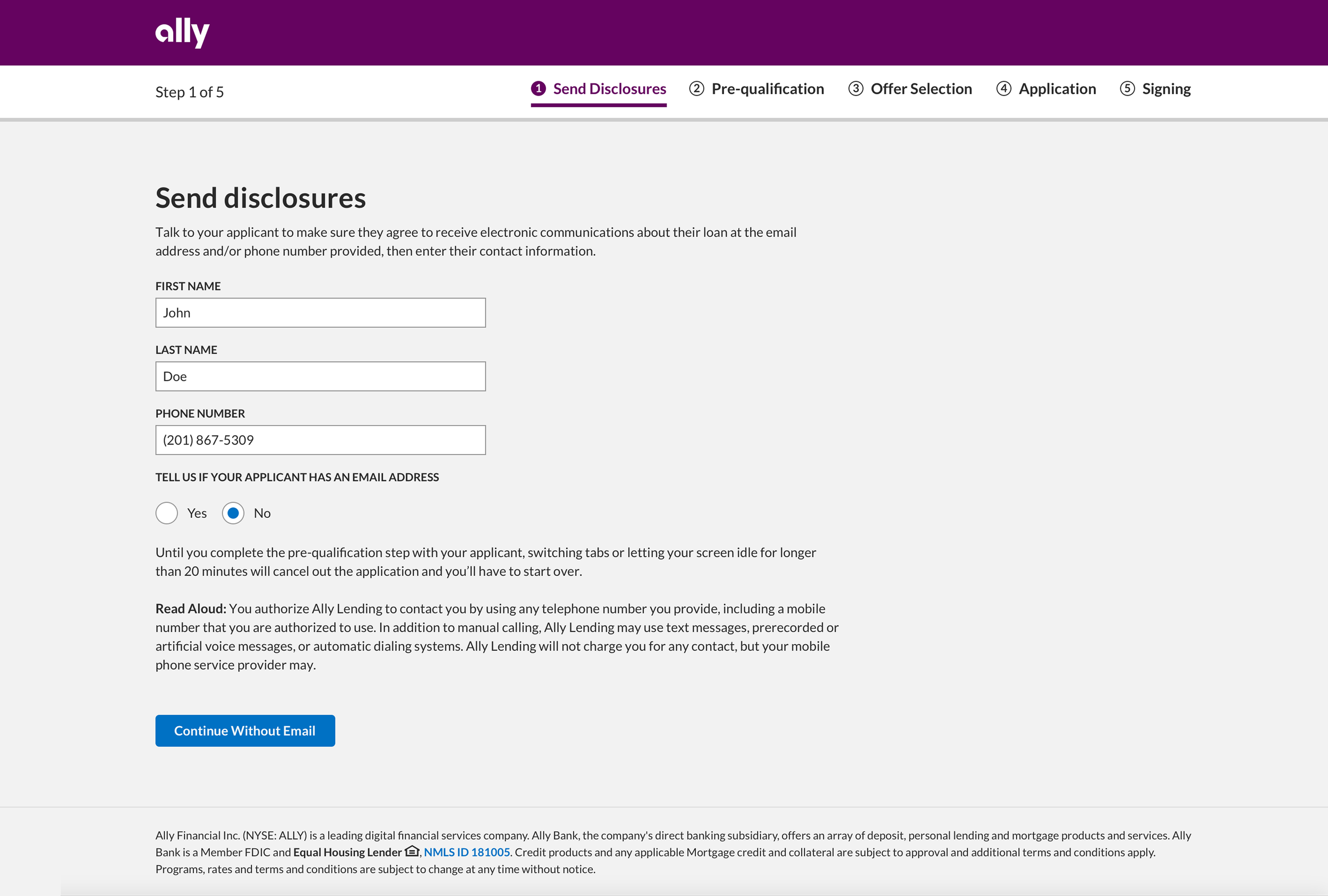

The following screens represent key interactions within Step 1 of the hybrid application flow, specifically focused on signing disclosures. While these do not show the full end-to-end experience, they capture the critical design decisions that made the process more accessible, compliant, and easy to follow.

Email Selection

I began by creating a decision point early in the workflow. Providers are prompted to indicate whether the applicant has an email address. This step establishes the correct path and ensures that non-digital borrowers are not forced into an email-dependent process that they cannot complete.

Non-Email Flow Activation

If the applicant does not have an email and the provider chooses to continue, a modal appears with clear, concise instructions. The system prompts the provider to print the necessary documents for the applicant to sign with pen and paper. This screen was designed to reduce cognitive load and minimize error by guiding providers step by step.

Terms and Conditions Screen

This screen provides providers with all required documents, along with specific instructions on what must be reviewed and signed by the applicant. After physical signing, the provider can upload the signed forms directly into the system to continue the application. I focused on keeping the layout clean, actionable, and supportive of compliance needs.

These screens reflect my focus on creating a simple and scalable alternative for borrowers who cannot access digital tools while maintaining legal integrity and supporting operational efficiency.

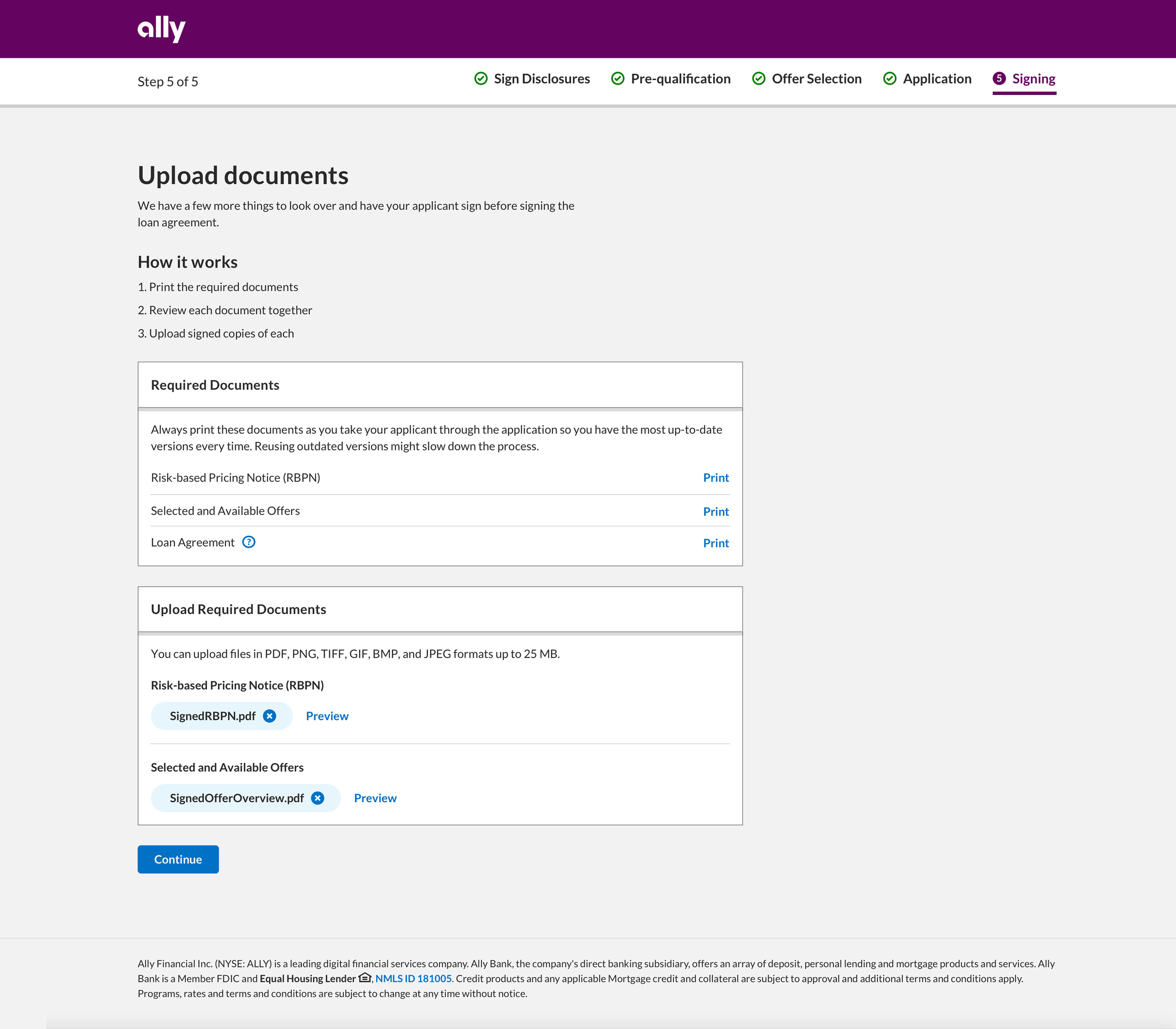

The following screens represent Step 5 of the hybrid application’s happy path. At this stage, the applicant has completed Steps 2 through 4 and is ready to review and sign the final set of documents, including the loan agreement.

This moment in the flow required careful attention to both compliance and user clarity. I designed the screens to ensure providers had everything they needed to guide the borrower through the signing process without confusion or unnecessary back-and-forth.

Once the required documents are signed and uploaded, the application enters the final review stage. I worked closely with Customer Care to define how these submissions would be flagged, reviewed, and tracked. After review, the provider receives notification of the application’s approval or denial within two to three business days.

This part of the flow was critical in creating confidence for both providers and internal teams. My goal was to ensure a smooth handoff between external users and Ally’s backend operations, while minimizing delays and reducing support burden.

Provider portal enhancements

To support the new hybrid workflow, I also introduced updates to the provider portal. One key enhancement addressed a recurring issue identified during stakeholder interviews: when Customer Care needed providers to re-upload or re-submit documents, there was no simple, self-service option to do so.

I designed a new interaction that allows providers to resubmit documents directly within the portal using the application’s TRN (Transaction Reference Number). This improvement reduced turnaround times, minimized the need for back-and-forth communication, and helped ensure that applications remained compliant and on track for timely review.

This portal update reflected my broader goal for the project—to create solutions that worked not just for borrowers, but for every team supporting the lending process behind the scenes.

Admin portal enhancements

In response to direct feedback from Ally’s Customer Care team, I designed two key enhancements to improve visibility and prioritization within the admin portal. My goal was to reduce the time it took for agents to identify and act on hybrid applications, especially those requiring manual intervention.

Time-Sensitive Indicator

I introduced a new clock icon on the admin dashboard to flag applications that needed urgent manual review. This helped Customer Care triage their workload more effectively and focus on time-sensitive cases without relying on external prompts.

Hybrid Application Banner

To reduce confusion and improve navigation, I added a prominent banner to all hybrid application accounts. This visual cue appears at the top of each TRN record, allowing agents to quickly distinguish hybrid submissions from standard digital ones.

These updates streamlined internal workflows and supported faster, more accurate handling of hybrid applications. They also reinforced my broader design principle for this project—making critical information easy to find and act on, without adding unnecessary steps.

The redesigned hybrid application flow launched successfully and created a more inclusive path forward for borrowers without digital access. By removing email dependencies and providing providers with clear workflows and upload capabilities, the solution reduced reliance on workaround email hacks, improved operational efficiency, and ensured compliance across all key steps.

This project gave me the opportunity to lead a high-impact initiative focused on accessibility and equity within one of the most regulated environments I have worked in. I learned how to balance the needs of users, legal teams, and business stakeholders while pushing for thoughtful innovation grounded in empathy.

It also reinforced the importance of designing for users who are often left behind by digital-first strategies. I am proud to have played a role in transforming Ally’s lending process into something more inclusive, scalable, and aligned with the realities of every borrower—not just those who are digitally fluent.